Accounting Experts

Clients Handled

Accounting Tools Mastered

Years' Combined Experience

Get the entire range of bank reconciliation services here, from bank statement reconciliation, credit card reconciliation, invoice matching with your ledger, and balance sheet reconciliation with VE’s talented virtual accountants.

Let your financial reports be accurate! Accounting auditors at VE can help you get a detailed financial report of your business and also ensure all your accounting reports and financial statements are accurate.

Find your company’s total cost with VE’s offshore accounting experts by analyzing each area of your business such as production, operation, services, and understand how you can save money in each area.

Are you poor with credit control? No worries! VE's accountants can help you chase your customers regularly to clear overdue invoices, set credit limits, find potential customers, and much more.

A highly motivated and versatile Financial Analyst with strong grasp of Bookkeeping, Accounting, Records Keeping, Budgeting, Forecasting, Variance Analysis, etc.

Highly experienced in Bookkeeping, Taxation with extensive knowledge and understanding of QuickBooks.

Proficient in US GAAP and has expertise in Bookkeeping, maintaining financial accounts, and preparation of financial statements.

Kick-start your project straightaway with our popular No-Obligation, No-Payment, 1-Week Free Trial. Continue with the same resource if satisfied.

Our free, quick, bespoke hiring process helps you save on not just expensive local recruitment fees but also lengthy waiting periods to hire just one resource.

Get your own virtual accountant, do away with pesky issues such as HR, Admin, Payroll, etc., and only pay your offshore accountant's salary.

As an ISO27001:2013 certified and CMMiL3 assessed company, VE assures its clients of breach-proof data security and confidentiality at all times.

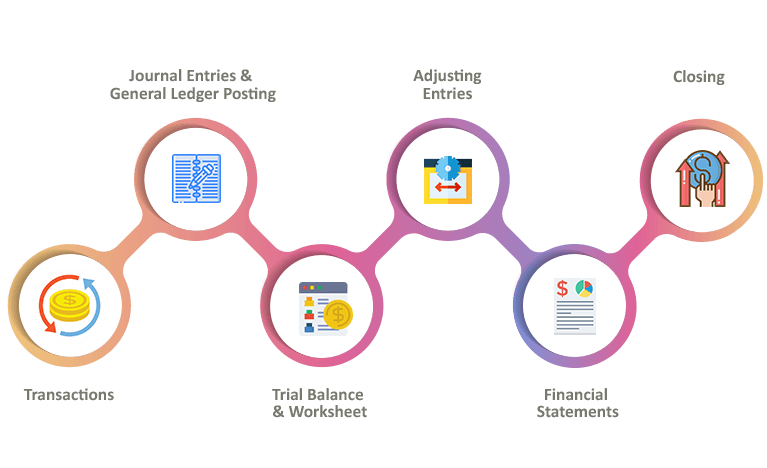

Financial transactions such as paying a debt, sales and purchase of assets, sales revenue and expenses.

Next comes recording these transactions in the company’s journal in a chronological order and posting these general entries to the general ledger, offering an overall view of all transactions.

A total balance is calculated for the accounts at the end of the accounting period. And Worksheet helps identify errors or misses if the debits and credits on the trial balance don’t match.

At the end of the company’s accounting period, adjusting entries have to be posted to accounts for accruals and referrals.

The company’s financial statements can then be readied by preparing the balance sheet, income statement, and cash flow statement.

The last step involves closing the revenue and expense accounts of the company and zeroing out for the next accounting cycle.

Every file we ever need, VE’s expert delivers on time

Able to get an accurate report of where our business stands

Great example of how outsourcing can work

No card details required.

Senior team lead assistance.

Keep all the work. It's yours.

It has been noticed that companies are becoming more efficient, profitable, and competitive by choosing to ship...

Read More >

Businesses have been preferring to outsource finance and general accounting right from the onset of outsourcing, and this practice...

Read More >

Outsourcing payroll services to India has many advantages. Companies that send payroll services to India...

Read More >