Certified Financial

Managers

Accurate Business

Forecasting

Industries

Served

Years’ Average

Experience

Kick-start your project straightaway with our popular No-Obligation, No-Payment, 1-Week Free Trial. Continue with the same resource if satisfied.

Our free, quick, bespoke hiring process helps you save on not just expensive local recruitment fees but also lengthy waiting periods to hire just one resource.

Get your own 'remote workplace in India’, do away with pesky issues such as HR, Admin, Payroll, etc., and only pay your offshore Finance Manager’s salary.

As an ISO 27001:2013 certified and CMMiL3 assessed company, VE assures its clients of breach-proof data security and confidentiality at all times.

Highly experienced in Bookkeeping, Taxation with extensive knowledge and understanding of QuickBooks.

A highly experienced professional in the fields of accounting, bookkeeping, BRS, US/Canada payroll operations, US federal and state taxes, client servicing, and performance management in a shared service environment.

A seasoned professional proficient in accounting, bookkeeping, Accounts payable and receivable and has been a team player with great client management skills and project management skills.

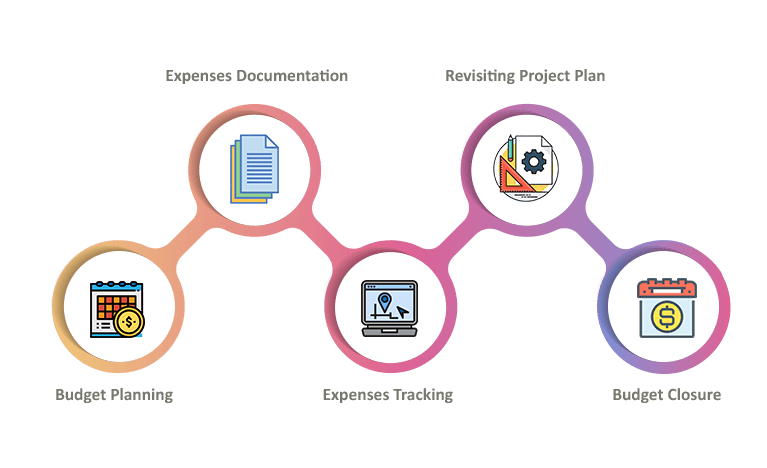

Before the project starts, your offshore finance manager in India will write down and put together information about the budgeted financial needs of the project. In order to make a realistic budget, VE’s finance manager will explain what plans and strategies are in place and estimate how much they will cost.

Once you’ve approved the budget planning, cost estimate and the project has started, your remote financial manager from India will start keeping an eye on all expenses, preferably once a week.

At this stage of the financial management process, your corporate finance manager revisits and updates your financial expense report. The project plan is then revised with relevant data.

The financial expenses report is revisited and updated to ensure that the project supervisor has access to the latest information throughout the project’s lifecycle. As a result, all the financial expenses and project plans are up to date and ready for any type of review undertaken by the company.

When the task is completed without any further expenditures, it is marked as complete. Once you approve the final financial expense report, it is included in the project closure form for review.

It has made me possible to live the kind of life I wanted. I can travel & run my business.

She's worked hard and battled through family commitments to deliver the work we needed.

We are really happy with Virtual Employee’s finance and accounting team.

No card details required.

Senior team lead assistance.

Keep all the work. It's yours.

It has been noticed that companies are becoming more efficient, profitable, and competitive by choosing to ship...

Read More >

What is one of the most important factors that contributes to the slow-paced growth of an organization...

Read More >

Businesses have been preferring to outsource finance and general accounting right from the onset of outsourcing, and this practice...

Read More >