Certified Payroll Experts

Global Clients Handled

Accounting Tools Mastered

Years’ Combined Experience

A highly skilled accountant with sound knowledge of receiving, processing, verifying, and reconciling distinct types of invoices.

A seasoned accounting professional proficient at tracking payroll expense claims and counting overtime payments and salary advances.

An experienced accounting specialist adept at working with internal divisions to collect, examine, and interpret meaningful financial data.

Kick-start your project straightaway with our popular No-Obligation, No-Payment, 1-Week Free Trial. Continue with the same resource if satisfied.

Our free, quick, bespoke hiring process helps you save on not just expensive local recruitment fees but also lengthy waiting periods to hire just one resource.

Get your own 'remote workplace in India’, do away with pesky issues such as HR, Admin, Payroll, etc., and only pay your remote payroll expert’s salary.

As an ISO27001:2013 certified and CMMiL3 assessed company, VE assures its clients of breach-proof data security and confidentiality at all times.

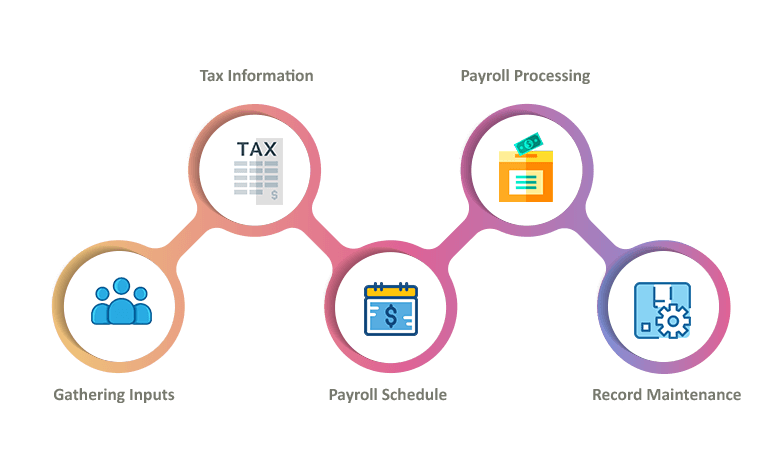

Your dedicated payroll expert will secure the employee’s EIN and establish the state or local tax IDs.

The payroll specialists at VE then collect the employee tax and financial information such as W4 forms and 1099 forms.

Our remote payroll management team assists you in choosing the right payroll schedule, setting up the agreed payment schedule and identifying tax payment dates for your business.

VE’s offshore payroll services help you document hourly employee schedules, calculate overtime pay, gross pay, and net pay after determining deductions and issue payment to employees via paper check, direct deposit, etc.

When payday is over, your professional payroll expert from India will start maintaining payroll records, cross-check potential miscalculations or errors and report new hires to the IRS.

It has made me possible to live the kind of life I wanted. I can travel & run my business.

We are really happy with Virtual Employee’s finance and accounting team.

She's worked hard and battled through family commitments to deliver the work we needed.

No card details required.

Senior technical architect's assistance.

Keep all the work. It's yours.

What is one of the most important factors that contributes to the slow-paced growth of an organization...

Read More >

An efficient payroll system plays a key role in employee satisfaction. As an employer, you are expected to...

Read More >

Outsourcing payroll services to India has many advantages. Companies that send payroll services to India...

Read More >