Tax practitioners in the West have become increasingly aware of the benefits of outsourcing Tax Return Preparation to India, which has grown rapidly over the last few years. One of the most significant benefits of using an offshore tax outsourcing service is that it solves the frequently serious issue of hiring qualified seasonal workers for in-house tax preparation...

Also, due to the time zone variations between the United States and India, a return that is submitted abroad for preparation in the afternoon can be finished in a matter of hours (Indian daylight) and downloaded by the U.S. CPA the following morning. By outsourcing tax preparation to India, which offers such a rapid turnaround, businesses may guarantee greater customer satisfaction and client retention. Remote Tax Preparation can drastically cut down on the number of paper records kept as it shifts tax preparation to a system that is primarily web-based.

Why Should You Outsource Tax Preparation Solutions to India?

One of the most time-consuming tasks that also have an impact on an organization’s productivity is tax preparation and auditing. Instead of engaging in tax preparation, the company might make greater use of its time by focusing on other key business operations. Because of this, outsourcing tax preparation can help you save both money and crucial time.

By outsourcing Tax services in India, CPAs focus on higher-margin activities like tax advice, cutting labour costs, and processing tax returns more quickly. It frees up the time of tax experts from routine tasks like data entry and form filing. The time that is saved can be put to better use in tax and estate preparation.

Why Should You Outsource Tax Preparation to Virtual Employee?

Any business or accounting firm may benefit from outsourcing Tax Preparation to Virtual Employee while also strengthening customer relationships and receiving seamless and secure virtual Tax Preparation from India.

Hire a Tax Preparer from India with experience in Forms 1040 for individuals, 1065 for partnerships, and 1120 for businesses and corporations from VirtualEmployee.com. Our remote Tax Preparers from India can deal with many tax situations, including individual income taxes, partnership income taxes, fiduciary income taxes, and income taxes for “C” and “S” corporations, among others. Using the greatest tax preparation and processing software available, such as Drakes Lacerte, Turbo Tax, and Ultra Tax, the devoted tax experts engaged by Virtual Employee, can offer personalized tax preparation and processing services.

You can scale up or down the ideal number of remote tax preparers in India at any one time as your tax preparation needs change (starting at just $8 per hour).

Major Trends in Tax Preparation

It is important to be aware of the trends accounting outsourcing firms in the USA, India, and other developed nations follow as we prepare the comprehensive guide. In terms of tax preparation and return filing, the key trends that are influencing this sector of accounting and finance are listed below.

- Creation of Real-time Tax Documents – In the past, tax season would require many companies to spend days and nights preparing taxes and filling out returns. Nowadays, CPA tax preparation companies are hired all year long to prepare paperwork, including books, audits, and other tax-related tasks, in order to lessen trouble during tax season.

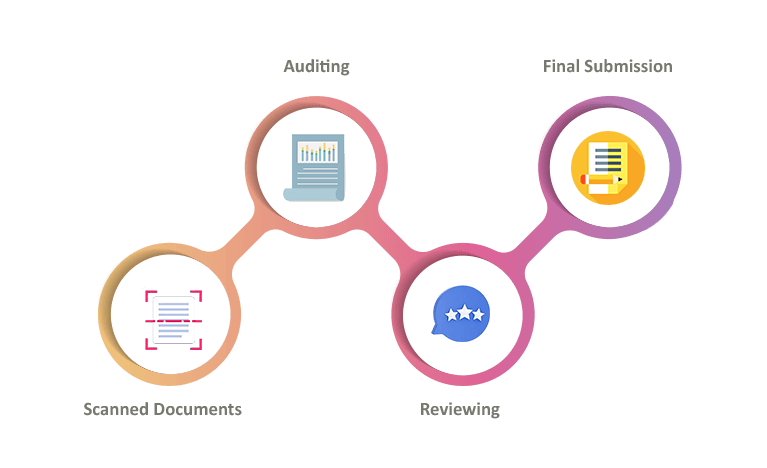

- Digitization – Several invoices, receipts, payroll vouchers, and other documents are created and received in paper form. To ensure efficient accounting and tax preparation, however, everything must now be digitalized. Due to the fact that the majority of CPA Tax Preparation companies in India scan financial and accounting papers so that they have a digital copy of all financial documents, Tax Preparation outsourcing can help you with this aspect.

- Safe Tax Preparation and Filing – The popularity of outsourcing Tax Preparation services to India ensures that taxes are processed securely using a secured infrastructure. To ensure that clients who utilize outsourced tax return services in India can benefit from secure accounting and taxation services, the businesses employ licensed accounting software together with digital signatures, encryption, etc. The top-rated and most well-known tax preparation outsourcing companies in India additionally offer tax preparation services in a corporate setting, utilizing the business’s accounting system to offer even more safe tax preparation services.

Advantages of Outsourcing Tax Return services to India

- Improved Efficiency in Tax Returns –By outsourcing work, a company may anticipate that its returns will be thoroughly computed after taking all relevant factors and legal requirements into account. There is consequently almost little room for error. This would also ensure that returns are prepared appropriately and submitted on time.

- Boost In-house Workforce Productivity – By relieving in-house employees of routine tax preparation tasks, outsourcing Tax Preparation to India can boost employee productivity. The employees of an Indian company that outsources tax return services can take care of it.

- Short-term Tax Solutions – By outsourcing Tax Preparation, you may be rest assured that any tax-related issue or enquiry will be resolved right away. With the assistance of seasoned professionals, any tax issue can be resolved swiftly and on time.

- Lower Expenditures – A remote Tax Preparer from India can be hired for 70% to 80% less money than engaging a local tax preparer. This may assist in cutting down on up-front costs. Also, hiring remote workers can save the cost of managing and training accounting staff.

The Significance of Filing Taxes

Tax returns are critical for any organization because they demonstrate that it follows the law and wins society’s respect and reputation. An organization gains respect in the eyes of the authorities as a responsible taxpayer by filing taxes on time. Outsourcing tax computation and filing is a smart option for any firm because it is a complex operation that takes a lot of time and knowledge. This way, a corporation can engage professionals not just in the computation and filing of its tax returns, but also in making critical financial and commercial decisions to save money on taxes.

A wide range of businesses, including banks, financial institutions, construction companies, and food organizations, hire Tax Preparers from Virtual Employee.

- Financial Institutions

- Supermarkets

- Insurance Companies

- Manufacturers

- Charities and NGOs

- Utilities

- Health Authorities

- Industrial Organizations

- Retailers

- Educational Institutions

- IT Companies

- Engineering Firms

If you’re looking for an outsourcing partner for your Tax Preparation, here are a few of the reasons why you should choose VE:

- Dedicated in-house Tax Preparation team

- Project estimate within 24 hours

- Flexible end-to-end support

- 600+ Satisfied clients

- 10+ types of industries served

- 2X faster task completion

- 80% quicker onboarding process

- 100% money-back guarantee

- 24×7 customer support

To give you a significant competitive advantage through outsourcing, our dedicated remote Tax Preparers at VE are available to assist you. To strengthen your workforce, look for personal Tax Preparation services in India at Virtual Employee. When compared to alternative strategies for hiring and retaining qualified employees, working with a certified Tax Preparer may save you time and effort.